A mechanism to allow all Pakistani resident and non-resident investors to open an online account linked to the capital market to invest in stocks has been approved by the Securities and Exchange Commission of Pakistan (SECP).

According to the notification issued by SECP, the new system, as a key indicator of the Commission’s digital transformation agenda, will allow investors to create accounts with a broker without submitting documents physically.

Read more: SECP approves launch of first peer-to-peer lending platform

Guide to Open Online Account With SECP

Here is how you can set up your online account with SECP to invest in stocks, as per updated guidelines by the Commission.

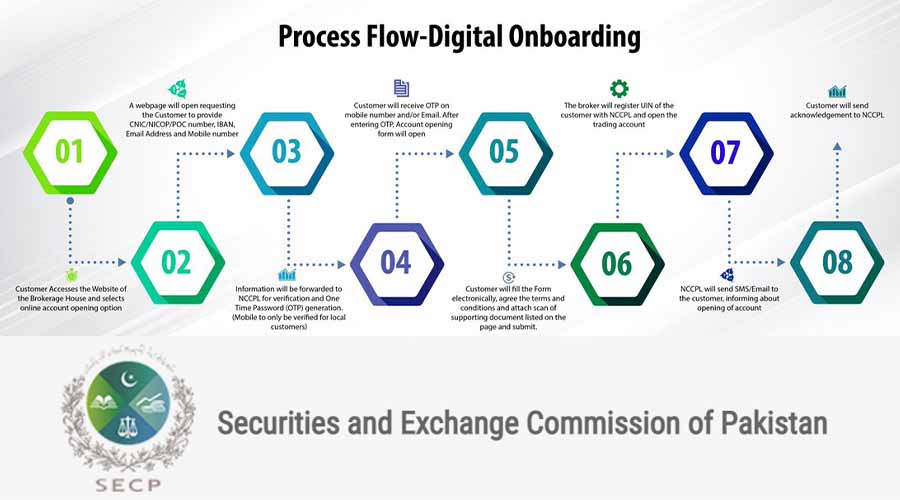

- The client gains access to the website of the brokerage account and chooses the online account opening option.

- After clicking a new window will pop up, which will be requesting user data such as CNIC/NICOP/POC number, your bank details (IBAN), mobile number and email address.

- After inserting information, the data will be transferred to the NCCPL for verification, and One Time Password (OTP) will be generated by the system.

- The OTP will be sent to users’ mobile number and/or email address. After inserting the OTP, the account opening form will open.

- The customer attach all the required documents digitally and check the agree to the terms and condition box.

- Then the broker will register the UIN of the customers with NCCPL, and open the trading account.

- NCCPL will send an SMS or an Email to the customer, notifying user about account creation.

- After identification, the customer will send an acknowledgment to the NCCPL.

It can be hard to select the right brokerage account, but with the Commission’s latest automated account opening process, things are getting a lot easier.

The new structure would accelerate the stock markets of Pakistan and make a major contribution to the country’s economic growth by channeling investments and savings through related investment pipelines.